Getting more out of your B2B focus groups

Focus groups often get an unfair rap. In high-stakes B2B environments, the phrase can conjure up images of wasted time and wasted money.

But focus groups provide a valuable opportunity to learn firsthand from customers and prospects about the issues that matter most. As a primary, qualitative research tool, focus groups can be used to uncover the emotional and rational reasons behind behavior, brand loyalty, and the buyer journey.

Extracting value from focus groups requires proper prep work, skilled moderating, and a detailed analysis integrated with other discovery work. This ensures that the time, effort, and resources required for a B2B focus group pay off in insights that drive results.

Here are the critical steps you can take to make sure that your focus group pays off for your business, and how to demonstrate the value of a focus group.

Set Objectives

A clear, distinct objective allows for a more focused discussion, leading to deeper understanding of the issues at hand. Defining a clear-cut purpose can filter out surface-level findings and helps avoid leaving a negative impression among participants (who are likely customers).

The objective depends on the progress made during the discovery process, but typically falls into one of three categories:

- Understanding broad, common topics

Early in discovery work, focus groups provide a wide view of the industry, audience, and issues, revealing overarching trends. This approach usually requires extensive follow-up and isn’t recommended for B2B, where these themes can be discovered elsewhere. - Validating or refuting themes

A focus group that occurs sometime in the middle of discovery work can confirm or deny previously uncovered findings among a broader set of customers. This is likely the best use of a B2B group. - Testing creative

Towards the end of discovery and into brand development, you can test the industry tropes and customer preferences uncovered during prior discovery work. The focus group can tell you which directions resonate and which fall flat.

Recruit Participants

The right mix of participants can make or break a focus group. It’s important that the group is representative of the audience as a whole, but with enough commonalities that the conversation will be productive. Group participants also need to be able to talk openly and honestly among peers.

Recruiting for Focus Groups: B2B vs. B2C

Participant recruiting is probably where B2B focus groups differ most from traditional B2C. Keep these tips in mind when you begin your recruiting process:

- Be persistent. Targeted audiences make for a much smaller pool of possible participants. Professionals are often busy, making them difficult to reach and unlikely to participate.

- Beware of biases. Most participants are recommended and recruited by the sales force because they’re already fans of the brand meaning results could be positively skewed.

- Remember the bigger picture. Only one person from a given customer type or prospect may be represented, even though the purchase decision typically involves multiple roles and functions.

- Provide incentives. Monetary gifts are nice, but the general rule is that professionals need to feel valued and appreciated. A sincere thank you along with specifics on how their participation will ultimately benefit their own business goes a long way.

- Be sensitive to privacy concerns. Having competing businesses in the same group can become problematic if participants aren’t comfortable discussing their challenges or successes in front of the competition.

For B2B, consider factors including job title, role, and company size. It’s possible that multiple groups will be needed to achieve the correct balance of sample representation and commonalities for a productive discussion.

One of FVM’s large telecom clients segmented its audience into two buckets: enterprise and SMB. These two groups both faced challenges when it came to telecom needs but approached them from very different contexts. Our client needed to engage with both audiences and sought to determine the best way to approach each.

So we conducted two separate focus groups: varying participants’ job titles, longevity with our client, and industries represented between both groups.

Craft the Discussion Guide

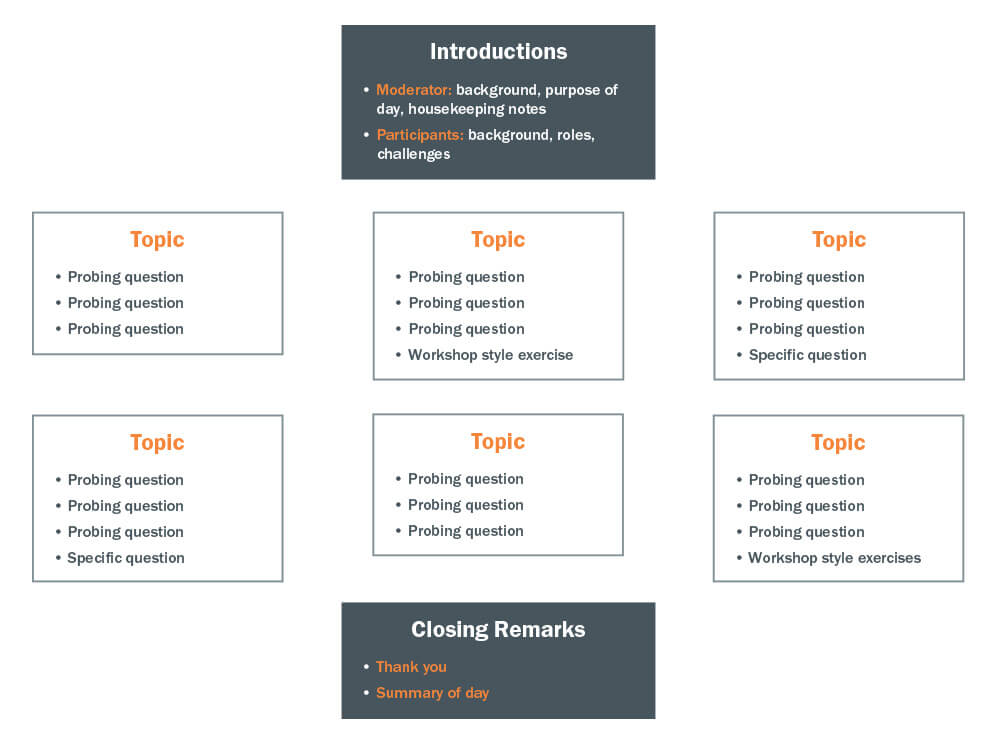

Realistically, a B2B focus group will be 2.5 hours total, including time for introductions, breaks, and closing remarks. It’s important to be realistic about what can and cannot be accomplished in this window. Plan for five to six main topics, with probing questions or workshop-style exercises to spur dialogue. Remember: the guide, while important, is merely a tool. It’s up to the group and moderator to engage in dialogue that covers the key topics.

Allow participants to dictate the flow and pace of the conversation by crafting a fluid guide that starts out broader and moves into more specific lines of questioning. Let participants determine the length and depth of each conversation, highlighting which topics are most important.

A nonlinear guide format helps the moderator follow the room, rather than being restricted to a predetermined order of events.

Use the objectives discussed above as the key starting points for your discussion guides.

Understanding broad, common topic

Include open-ended questions that ask participants about their roles, challenges, and competition.

Validating or refuting themes

Carefully choose topics that require further explanation. Plan to discuss each one, allowing enough time to hear from each participant and follow up on responses. Don’t waste time on topics that can be explored elsewhere.

Testing creative

Share creative directions to determine how certain images, concepts, and colors make the participants feel. In B2B, focus groups are the perfect opportunity to establish which industry themes are most expected, needed, or overused.

For example, we used a focus group to test one industry’s most common uses of imagery: blurred lights, moving traffic, and stock photography of smiling business people. When we ran these tropes by group participants, we discovered that the photos of smiling people were problematic. Group members asked, “Are the people supposed to represent me or the vendor?” On the other hand, the images denoting speed resonated well.

Moderate the Discussion

Skilled moderators are able to elicit information beyond “top of mind” responses, uncovering rational, behavioral, and emotional drivers. In order to reach this second and third-level information, keep these functions in mind while moderating:

- Understand the objective and enough about the subject matter to speak intelligently on it.

- Make no assumptions and remain unbiased, maintaining an open mind to all opinions and thoughts.

- Demonstrate respect for the participants, proving their time is valuable and their voices are being heard.

- Maintain a high energy level throughout varied tasks and question types, including open-ended questions and questions that allow participants to jot down answers.

- Manage the conversation, diving deeper where necessary and tactfully cutting off irrelevant topics or commentary.

Analyze the Results

Focus groups represent just one facet of discovery, so it’s important to integrate your findings with data from all other sources. By comparing and contrasting results with interviews, web analytics, and other discovery methods, you’ll find that themes and trends will emerge.

Keep an eye out for these common clues in focus group output:

- Polarizing conversations that left participants on different sides of the issues often indicate topics that need further exploration and validation.

- Topics on which participants spent more time are most likely hot-button issues.

- Conversations among the participants could suggest areas where there is a desire to learn more from peers. It could also signify a place for the client to enter the conversation as a thought leader.

Focus groups can provide valuable information in a short amount of time. With the appropriate preparation, participant mix, moderation, and analysis, you can gain valuable understanding of your client’s industry, competitors, audience, and challenges laying the foundation for a powerful brand or campaign.

Learn More about B2B Focus Groups